nassau county income tax rate

The US average is 46. Ownership eligibilityowning a property for at least 12 consecutive months before filing for the exemption.

Nassau County collects on average 179 of a propertys assessed.

. 2 hours agoTom Suozzi and spouse income. Household Size Very Low 50 Low 80 Moderate 120. Assessment Challenge Forms Instructions.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Other municipal offices include. A county-wide sales tax rate of 1 is applicable to localities in Nassau County in addition to the 6 Florida sales tax.

How to Challenge Your Assessment. NYCs income tax surcharge is based on where you live not where you work. 904 225-8878 or 800 671-6774 Fax.

The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Nassau County Property Taxes Range.

Income eligibilityhaving a household income that does not exceed Nassau. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000. Nassau County property taxes are among the highest in the nation but there is good news there are many exemptions that help you reduce this tax bite often by a considerable margin.

Nasssau County Florida Tax Collector. Rates kick in at different income levels depending on your filing status. A county -wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax.

Based on latest data from the US Census Bureau. The steep NYC Income Tax. I had paid a NYC Commuter Tax until 1999 now good riddance.

Answer 1 of 4. Congress but did not disclose capital gains or spouses income. I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes.

Nassau County Economic Development Board 76346 William Burgess Boulevard Yulee FL 32097 Phone. The minimum combined 2022 sales tax rate for Nassau County New York is. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

Nassau County Property Taxes Range. Average Property Tax Rate in Nassau County. Nassau County Housing Strategy.

I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes. 904 225-8868 Send an email Send us an email. Nassau County New York.

Town of Hempstead Receiver of. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000. This is the total of state and county sales tax rates.

While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be. The lowest rate applies to single and married. What is the sales tax rate in Nassau County.

2022 Income Limits Published by Florida Housing Finance Corporation. - The Income Tax Rate for Nassau County is 65. Some cities and local governments in Nassau County collect additional.

Income and Salaries for Nassau County - The. - Tax Rates can have a big impact when Comparing Cost of Living. If you would like.

New York City has four tax brackets ranging from 3078 to 3876. Tax Rates By City in Nassau County New York. Visit Nassau County Property Appraisers or Nassau County Taxes for more information.

Nassau County property taxes are assessed based upon location within the county.

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Property Taxes Going Up In Nassau County Is Gas Tax Next

Long Island Homeowners Question School Tax Hikes After Districts Received Pandemic Aid Cbs New York

Property Taxes In Nassau County Suffolk County

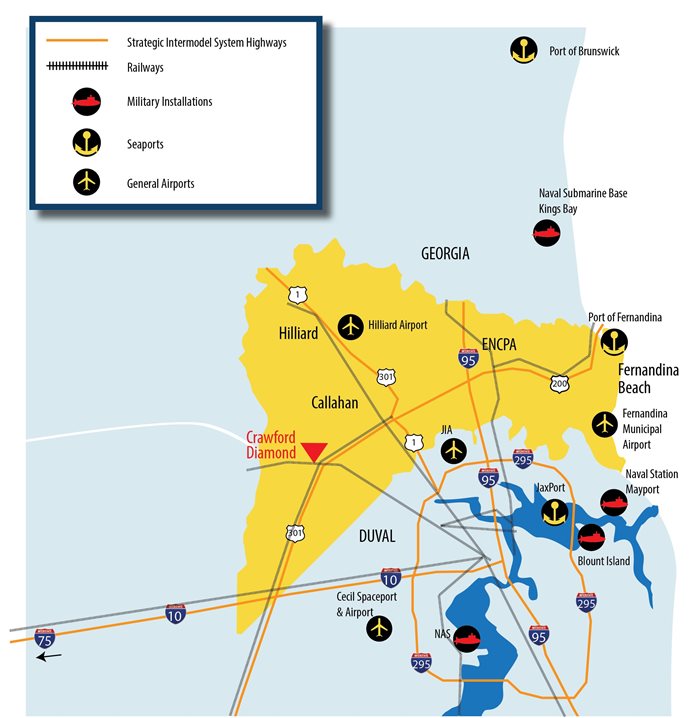

Transportation And Infrastructure Nassau County Economic Development Board

Tax Grievance Appeal Nassau County Apply Today

Signs Of Economic Vitality Abound In Nassau County Amelia Island Living

2022 Best Places To Live In Nassau County Ny Niche

Segregation Is Alive And Well In Nassau County Herald Community Newspapers Www Liherald Com

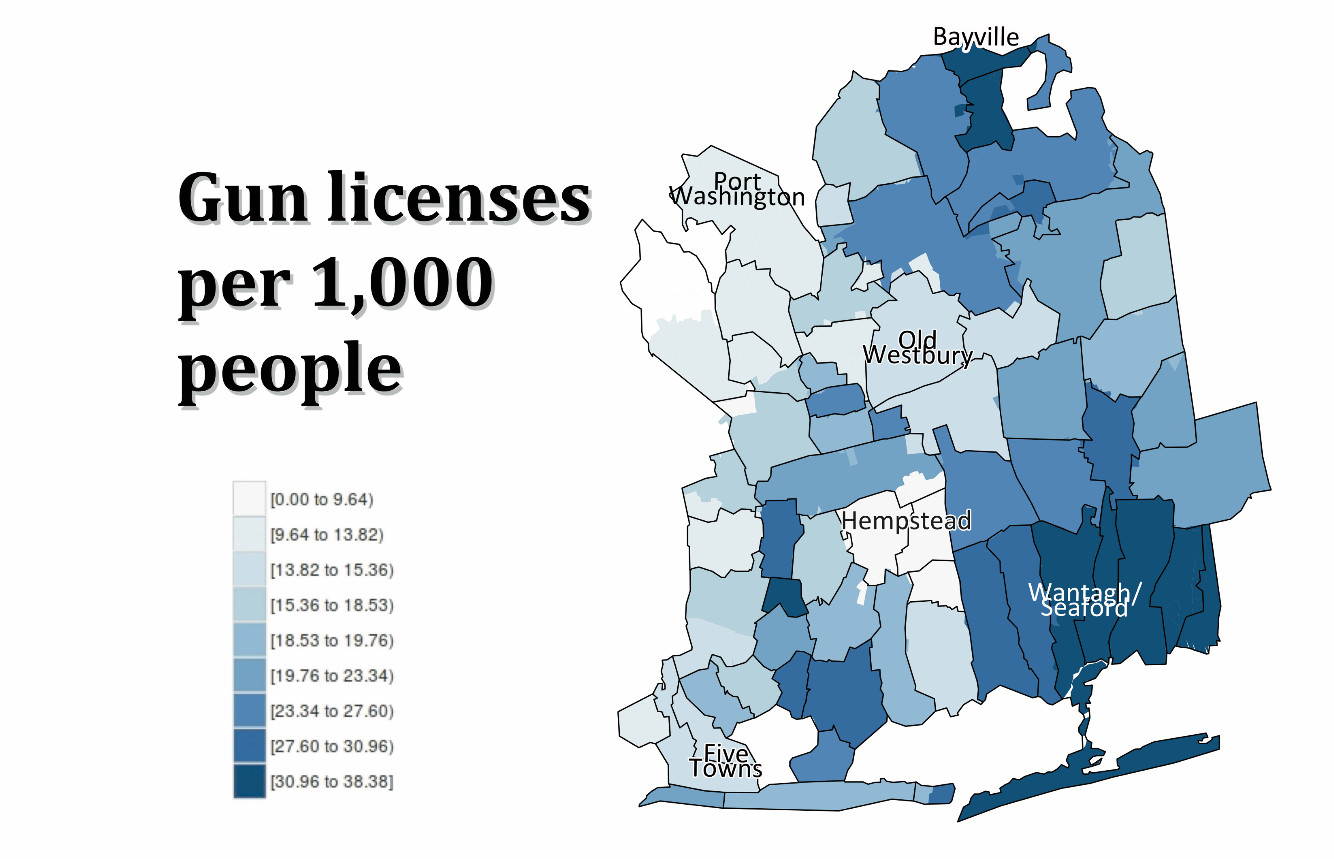

Getting To Know Nassau S Legal Gun Owners Herald Community Newspapers Www Liherald Com

All The Nassau County Property Tax Exemptions You Should Know About